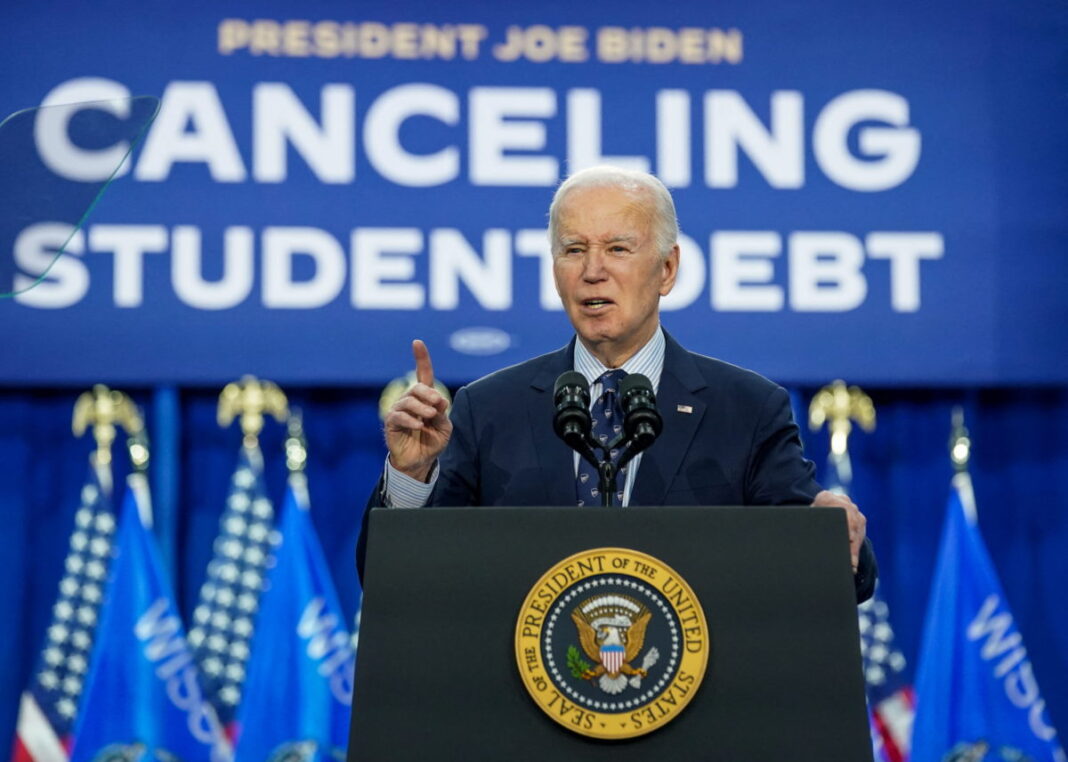

President Joe Biden’s administration has taken unprecedented strides in easing the burden of student loan debt, canceling loans for over 5 million Americans—more than any previous president. This wave of relief totals $183.6 billion, achieved despite the Supreme Court’s rejection of Biden’s broader loan forgiveness plan.

Through regulatory adjustments, the Biden administration revitalized existing programs like Public Service Loan Forgiveness (PSLF) and Borrower Defense, which were previously criticized for their complexity and inefficiency. For instance, PSLF, created in 2007, has now forgiven debts for over 1 million public servants who committed to a decade of qualifying payments. Similarly, the Borrower Defense program, established in 1994 to aid students misled by their colleges, saw significant expansion, benefiting borrowers from defunct institutions like CollegeAmerica and Stevens-Henager College.

These targeted forgiveness measures address issues such as loan servicer errors and eligibility confusion, which plagued borrowers under previous administrations. They also serve as a contingency plan after the Supreme Court halted Biden’s marquee policy of canceling up to $20,000 per borrower for over 40 million Americans.

However, with the impending transition to a Republican administration led by Donald Trump, the future of these initiatives remains uncertain. Trump has previously criticized loan forgiveness, and GOP lawmakers aim to roll back Biden’s reforms. Programs like PSLF and Borrower Defense face potential tightening or elimination under plans such as Project 2025 by the Heritage Foundation.

While Biden’s actions have brought relief to millions, the ongoing political debate underscores the complexity of addressing student debt in a polarized environment. Borrowers now await clarity on how future policies will shape their financial futures.